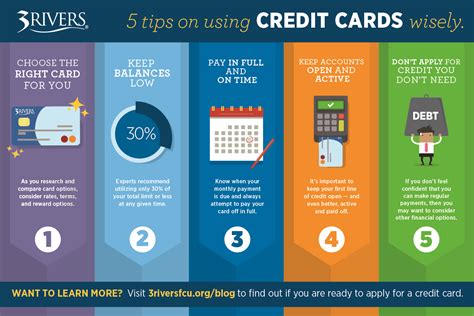

smart way yo use a credit card Ideally you would want to keep a low utilization, less than 30% but even lower like less than 10% is better. However, when you first start out, your credit limit is very low. So a very reasonable amount of monthly spending to cover your essentials will cause a relatively high utilization. Host-based card emulation. When an NFC card is emulated using host-based card emulation, the data is routed directly to the host CPU instead of being routed to a secure element. Figure 2 illustrates how host-based card .

0 · using my credit card

1 · tips for credit card usage

2 · proper use of credit card

3 · possible uses of credit cards

4 · how to utilize credit card

5 · how to utilise credit card

6 · how to operate credit card

7 · best usage of credit card

The HID TripTick® ATR220 reader not only is a barcode & NFC/RFID reader, but also includes .

1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less . The best way to use a credit card is to avoid paying interest by paying off the balance every month on time. Interest rates, known with credit cards as annual percentage rates, apply to. 1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%. Learn how to use credit cards to your advantage with these 8 smart tips. Discover practical strategies to manage your spending, improve your credit score, and enjoy the benefits of credit cards without falling into debt.

Ideally you would want to keep a low utilization, less than 30% but even lower like less than 10% is better. However, when you first start out, your credit limit is very low. So a very reasonable amount of monthly spending to cover your essentials will cause a relatively high utilization.

Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Want to use your credit cards the right way? Here are five important rules you should never break. Credit cards can be a helpful tool, or they can get you into serious debt that will. A smart way to use a credit card is to choose one that offers rewards. You can qualify for gifts, cashback, air miles, or gift cards by making regular purchases. Some cards also offer cell phone protection, travel insurance, and other special offers.

1. Transfer debt to a 0% APR card. One of the smartest ways to use a credit card when you have too much debt is to apply for a balance transfer card with an introductory 0% APR for a year or longer.

The best way to use a credit card is to start out by getting the right card for your goals and spending habits. Then, use it strategically by charging only the items you would buy anyway, paying your bill in full and on time and keeping your credit utilization low. 1. Establish or rebuild credit. Assuming you've worked out any personal issues with spending, signing up for a secured credit card is a smart way to build credit. To get the card, you make a cash. The best way to use a credit card is to avoid paying interest by paying off the balance every month on time. Interest rates, known with credit cards as annual percentage rates, apply to. 1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%.

Learn how to use credit cards to your advantage with these 8 smart tips. Discover practical strategies to manage your spending, improve your credit score, and enjoy the benefits of credit cards without falling into debt.Ideally you would want to keep a low utilization, less than 30% but even lower like less than 10% is better. However, when you first start out, your credit limit is very low. So a very reasonable amount of monthly spending to cover your essentials will cause a relatively high utilization. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Want to use your credit cards the right way? Here are five important rules you should never break. Credit cards can be a helpful tool, or they can get you into serious debt that will.

A smart way to use a credit card is to choose one that offers rewards. You can qualify for gifts, cashback, air miles, or gift cards by making regular purchases. Some cards also offer cell phone protection, travel insurance, and other special offers.

using my credit card

tips for credit card usage

1. Transfer debt to a 0% APR card. One of the smartest ways to use a credit card when you have too much debt is to apply for a balance transfer card with an introductory 0% APR for a year or longer.

The best way to use a credit card is to start out by getting the right card for your goals and spending habits. Then, use it strategically by charging only the items you would buy anyway, paying your bill in full and on time and keeping your credit utilization low.

proper use of credit card

possible uses of credit cards

$27.18

smart way yo use a credit card|how to utilize credit card