how does merchant verify the digital cash in smart cards Contactless smart card systems are closely related to contact smart card systems. Like contact smart card systems, information is stored . See more Similar to NXP’s TagWriter App for Android the new TagXplorer tool for PCs allows to read, analyze and write NDEF messages to NXP’s NFC tag and smart sensor ICs. The tool is designed using NXP’s TapLinx open Java API and it allows the user to perform NDEF Operations defined by NFC Forum on NFC Forum type 2 and 4 tags for NXP NFC Tag ICs.

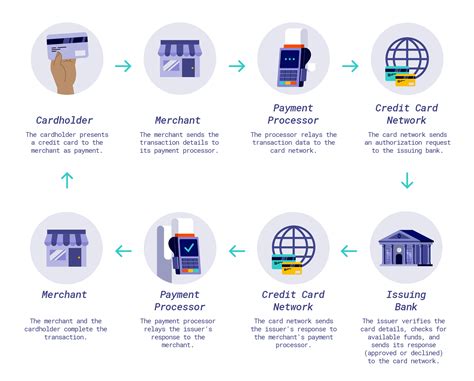

0 · merchant transaction processing

1 · credit card transaction processing

2 · credit card payment processing

NFC21 Tools allows you to write NFC tags conveniently on your Windows PC. The software is available from Windows 7 on and requires a corresponding NFC reader/writer, which is available in our shop: NFC-Reader. .

A smart card is a device that includes an embedded integrated circuit that can be either a secure microcontroller or equivalent intelligence with internal memory or a memory chip alone. The card connects to a reader with direct physical contact or with a remote contactless radio frequency interface. With an . See moreISO/IEC 14443 is the international standard for contactless smart chips and cards that operate (i.e., can be read from or written to) at a . See moreA contactless smart card includes an embedded smart card secure microcontroller or equivalent intelligence, internal memory and . See moreContactless payment is a change to the way debit or credit payment is handled when making a purchase. Contactless payment transactions require little to no physical connection . See more

Contactless smart card systems are closely related to contact smart card systems. Like contact smart card systems, information is stored . See more An important attractive feature of digital cash is that it permits (at least in theory) .

Smart cards enable customers to make payments without requiring . The process may look different depending on factors such as: Payment .Digital cash is a system of purchasing cash credits, storing the credits in your computer or .The benefit of the smart card is that you can verify the PIN or fingerprint securely offline. .

For applications requiring secure card access, the contactless smart card-based device can verify that the reader is authentic and can prove its own authenticity to the reader before starting a secure transaction. An important attractive feature of digital cash is that it permits (at least in theory) anonymous transactions. There are two main type of digital cash system: those which are based on smart cards, and those in which value is stored in a software program on the user’s PC. (g) Software Electronic Cash Systems Smart cards enable customers to make payments without requiring communication between the merchants and a centralized credit card information network or ATM clearing system. They also avoid the high costs of physical check clearing and, unlike checks, entail no credit risk. As such, smart cards offer the convenience of cash without collection . The process may look different depending on factors such as: Payment environment (in-person, online, or mobile) Payment channel (website, mobile app, brick-and-mortar retail location, mobile retailer, in-home service provider, etc.) Payment method (credit or debit card, bank transfer, digital wallet, etc.)

Digital cash is a system of purchasing cash credits, storing the credits in your computer or digital wallet, and then spending them when making electronic purchases over the internet or in person on a mobile device at the point of sale.

merchant transaction processing

credit card transaction processing

The benefit of the smart card is that you can verify the PIN or fingerprint securely offline. Different types of smart cards, from left to right: online authentication access (with the US DoD smart badge - military CAC), secure transaction with an EMV card (with a biometric sensor), strong identification with your national ID card.The share of payments made remotely increased for several payment instruments, most notably for checks and credit cards, especially in 2020, during the COVID-19 pandemic. While the cash-use share of transactions dropped for almost all merchant types, changes in check use were much more heterogenous.

When consumers make payments online, it is difficult for the merchant to verify their identity due to the faceless, relatively anonymous nature of the transaction. This can make some routine security mechanisms somewhat obsolete, which could make fraud and theft more likely in .

Contactless payments are accepted where you see the contactless payments symbol — four curved lines with a circle around them and a hand holding a card — on the merchant’s electronic payment terminal, device or card reader or on signage near the front door or checkout.Using STP or virtual cards can help improve your working capital as a small business owner without negatively impacting relationships with vendors and suppliers. This type of automated technology can ensure timely payments while still helping you optimize your cash flow.For applications requiring secure card access, the contactless smart card-based device can verify that the reader is authentic and can prove its own authenticity to the reader before starting a secure transaction.

An important attractive feature of digital cash is that it permits (at least in theory) anonymous transactions. There are two main type of digital cash system: those which are based on smart cards, and those in which value is stored in a software program on the user’s PC. (g) Software Electronic Cash Systems Smart cards enable customers to make payments without requiring communication between the merchants and a centralized credit card information network or ATM clearing system. They also avoid the high costs of physical check clearing and, unlike checks, entail no credit risk. As such, smart cards offer the convenience of cash without collection . The process may look different depending on factors such as: Payment environment (in-person, online, or mobile) Payment channel (website, mobile app, brick-and-mortar retail location, mobile retailer, in-home service provider, etc.) Payment method (credit or debit card, bank transfer, digital wallet, etc.)

Digital cash is a system of purchasing cash credits, storing the credits in your computer or digital wallet, and then spending them when making electronic purchases over the internet or in person on a mobile device at the point of sale.The benefit of the smart card is that you can verify the PIN or fingerprint securely offline. Different types of smart cards, from left to right: online authentication access (with the US DoD smart badge - military CAC), secure transaction with an EMV card (with a biometric sensor), strong identification with your national ID card.The share of payments made remotely increased for several payment instruments, most notably for checks and credit cards, especially in 2020, during the COVID-19 pandemic. While the cash-use share of transactions dropped for almost all merchant types, changes in check use were much more heterogenous.

When consumers make payments online, it is difficult for the merchant to verify their identity due to the faceless, relatively anonymous nature of the transaction. This can make some routine security mechanisms somewhat obsolete, which could make fraud and theft more likely in .Contactless payments are accepted where you see the contactless payments symbol — four curved lines with a circle around them and a hand holding a card — on the merchant’s electronic payment terminal, device or card reader or on signage near the front door or checkout.

credit card payment processing

nfc reader 教學

$64.00

how does merchant verify the digital cash in smart cards|merchant transaction processing