contactless card limit Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as. $24.00

0 · £100 contactless limit

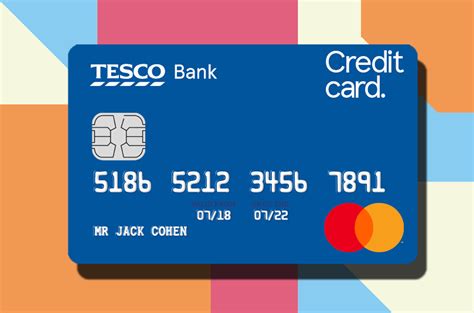

1 · tesco credit card contactless limit

2 · how much is contactless limit

3 · debit card contactless limit meaning

4 · debit card contactless limit maybank

5 · contactless phone payment limit

6 · contactless payment limit per day

7 · contactless card limit per day

Listen online to ESPN 106.7 radio station for free – great choice for Auburn, United States. Listen live ESPN 106.7 radio with Onlineradiobox.com . is a sports-format radio station serving Auburn and Opelika in Alabama. Its .

Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent .You can’t pay accidentally—your contactless card or payment-enabled mobile/wearable device must be within 2 inches of the terminal for the transaction to take place. And you won’t be .

A contactless credit card must be within inches of a contactless-enabled system, which usually requires you physically holding the card over the terminal. It is, however, possible. Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.

You can’t pay accidentally—your contactless card or payment-enabled mobile/wearable device must be within 2 inches of the terminal for the transaction to take place. And you won’t be billed twice, even if you accidentally tap twice. There isn’t a limit on how many times you can use a card because it’s contactless. What happens if you lose your contactless card and someone uses it? You should report your card as lost or stolen as soon as possible. If you’re sick of waiting for your EMV chip card payments to process, you’ll be happy to know contactless credit cards and payment systems are gaining popularity in the U.S.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it .

A contactless payment limit—also referred to as a cardholder verification method (CVM) limit—is the maximum amount your customers can pay with a contactless card before they're prompted for a signature or PIN verification.

Major financial institutions and multinational corporations now offer contactless payment systems to customers as contactless credit cards have become widespread in the U.S., UK, Japan, Germany, Canada, Australia, France, the Netherlands, etc., as consumers are likely to spend more money using their cards due to the ease of small transactions.

Mastercard, for example, has a 0 limit on contactless payments. If a consumer exceeds the card issuer’s limit, they can key in their PIN for additional security. A contactless card “is designed for lower values, for speed and convenience. .Contactless payments are accepted where you see the contactless payments symbol — four curved lines with a circle around them and a hand holding a card — on the merchant’s electronic payment terminal, device or card reader or on signage near the front door or checkout. A contactless credit card must be within inches of a contactless-enabled system, which usually requires you physically holding the card over the terminal. It is, however, possible. Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.

You can’t pay accidentally—your contactless card or payment-enabled mobile/wearable device must be within 2 inches of the terminal for the transaction to take place. And you won’t be billed twice, even if you accidentally tap twice. There isn’t a limit on how many times you can use a card because it’s contactless. What happens if you lose your contactless card and someone uses it? You should report your card as lost or stolen as soon as possible. If you’re sick of waiting for your EMV chip card payments to process, you’ll be happy to know contactless credit cards and payment systems are gaining popularity in the U.S.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it .

A contactless payment limit—also referred to as a cardholder verification method (CVM) limit—is the maximum amount your customers can pay with a contactless card before they're prompted for a signature or PIN verification.Major financial institutions and multinational corporations now offer contactless payment systems to customers as contactless credit cards have become widespread in the U.S., UK, Japan, Germany, Canada, Australia, France, the Netherlands, etc., as consumers are likely to spend more money using their cards due to the ease of small transactions. Mastercard, for example, has a 0 limit on contactless payments. If a consumer exceeds the card issuer’s limit, they can key in their PIN for additional security. A contactless card “is designed for lower values, for speed and convenience. .

£100 contactless limit

tesco credit card contactless limit

how much is contactless limit

debit card contactless limit meaning

debit card contactless limit maybank

Tiger Talk, Auburn Athletics' popular weekly radio show, returns for the 2024 season on Thursday nights at 6 p.m. CT. Hosted by Brad Law and the Voice of the Tigers, Andy Burcham, weekly guests will include Auburn head football .

contactless card limit|debit card contactless limit maybank