contactless card fraud statistics Contactless payment fraud accounted for 3% of total card fraud in the U.K. in 2020. Credit card fraud resulted in $268 million in losses in Australia in 2018. 43% of all fraudulent card transactions in Europe are related to e-commerce.

– Today, the Consumer Financial Protection Bureau (CFPB) took action against .

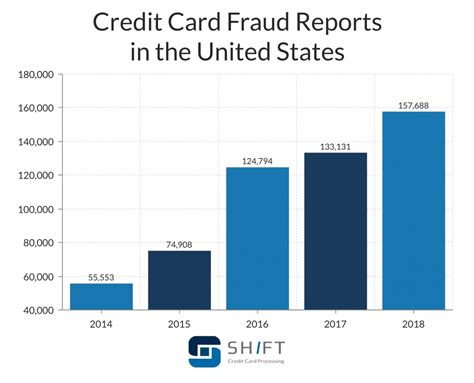

0 · us credit card fraud cases

1 · credit card fraud statistics

2 · credit card fraud cases by state

3 · 52 million credit card fraud

What NFC format are the memory cards for ID Stage 8? I'm trying to find out some information .

As in the past, the surveys collected annual data, and the effects of the pandemic can be seen by comparing 2020 estimates with those for previous years, such as in the shares of cards, ACH, and checks at large depository institutions from the DFIPS or in volumes for cards from the NPIPS. To study how the use of . See moreIn recent years, the FRPS has collected data for a sample of the largest depository institutions by deposit size through annual surveys.1 The annual . See moreAdoption of new payment technologies can be viewed not only in terms of more frequent payments by current users (i.e., intensity of use) but also in terms of payers using them for the first time (i.e., first-time use). The analysis below looks at the intensity of use of . See more Contactless payment fraud accounted for 3% of total card fraud in the U.K. in 2020. Credit card fraud resulted in 8 million in losses in Australia in 2018. 43% of all fraudulent .

In the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from Contactless payment fraud accounted for 3% of total card fraud in the U.K. in 2020. Credit card fraud resulted in 8 million in losses in Australia in 2018. 43% of all fraudulent card transactions in Europe are related to e-commerce..02 trillion in 2018 to 52 million Americans had fraudulent charges on their credit or debit cards last year, with unauthorized purchases exceeding billion. The median fraudulent charge also jumped 26% in the last two years, rising from to 0..05 trillion in 2019, before increasing to Now, data released in December by the Federal Reserve Payments Study find that amid the decline in the number and value of in-person card payments from 2019 to 2020, in-person contactless card pay increased both by number and value..11 trillion in 2020.No, the total possible fraud amount would be negligible, even with a lost or stolen card. In many countries where small amounts of contactless transactions are authorized, the number of contactless transactions that can be made in a row with a contactless EMV card is limited. Rory Wilson, a Vice President in Chase’s card issuing business, shares unique insight into Chase’s issuance of contactless-enabled cards which began in 2018 and what it means to millions of U.S. consumers. As adoption of contactless payments on mobile phones continues to increase, these two companies, and the business models and choices they employ, will have profound impacts on the competitiveness of the payments market and the future of open banking.

Experts argue that contactless cards, especially if connected to Apple Pay or Google Pay, are quite safe. But some say that there are ways to hack anything. At the Black Hat Asia 2020 summit, Leigh-Anne Galloway from the Cyber R&D Lab shared the statistics on how contactless payments impacted fraud statistics. And numbers are a bit confusing. Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards,. The ongoing coronavirus pandemic has bolstered the number of Americans using contactless payments to 51%, according to a new Mastercard poll.In the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from Contactless payment fraud accounted for 3% of total card fraud in the U.K. in 2020. Credit card fraud resulted in 8 million in losses in Australia in 2018. 43% of all fraudulent card transactions in Europe are related to e-commerce..02 trillion in 2018 to 52 million Americans had fraudulent charges on their credit or debit cards last year, with unauthorized purchases exceeding billion. The median fraudulent charge also jumped 26% in the last two years, rising from to 0..05 trillion in 2019, before increasing to Now, data released in December by the Federal Reserve Payments Study find that amid the decline in the number and value of in-person card payments from 2019 to 2020, in-person contactless card pay increased both by number and value..11 trillion in 2020.

us credit card fraud cases

No, the total possible fraud amount would be negligible, even with a lost or stolen card. In many countries where small amounts of contactless transactions are authorized, the number of contactless transactions that can be made in a row with a contactless EMV card is limited.

Rory Wilson, a Vice President in Chase’s card issuing business, shares unique insight into Chase’s issuance of contactless-enabled cards which began in 2018 and what it means to millions of U.S. consumers. As adoption of contactless payments on mobile phones continues to increase, these two companies, and the business models and choices they employ, will have profound impacts on the competitiveness of the payments market and the future of open banking.

Experts argue that contactless cards, especially if connected to Apple Pay or Google Pay, are quite safe. But some say that there are ways to hack anything. At the Black Hat Asia 2020 summit, Leigh-Anne Galloway from the Cyber R&D Lab shared the statistics on how contactless payments impacted fraud statistics. And numbers are a bit confusing. Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards,.

credit card fraud statistics

rfid chip 100 dollar bill

credit card fraud cases by state

52 million credit card fraud

You asked us for NFC cards you can print on.and we’ve delivered! We took our popular white PVC card and paired it with our hottest selling NTAG215 chip, to create a card you can embellish using your typical inkjet printer! The special .

contactless card fraud statistics|52 million credit card fraud