contactless card santander uk The limit on contactless payments will rise from £45 to £100 at some point later . NFC card is a type of card that uses near-field communication technology to exchange data with NFC-enabled devices. Learn what NFC is, how it works, and how to use an NFC card for contactless payments, access control, loyalty .

0 · tsb apply for contactless card

1 · santander pay by phone

2 · santander contactless card apply

3 · santander change pin

4 · santander change payment limit

5 · how to activate contactless card

6 · debit card tap limit

7 · contactless payment limit

The 49ers will be the No. 6 seed because of their win while the Rams dropped to No. 4 but still won the NFC West thanks to the Cardinals' 38-30 loss to the Seahawks. . NFL playoff schedule 2022 .The official source for NFL news, video highlights, fantasy football, game-day coverage, schedules, stats, scores and more. . 2022 — WILD CARD . Examining NFC playoff picture ahead of 'MNF .

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.

You can now link most Santander debit cards and credit cards to your smartphone or device to .

tsb apply for contactless card

santander pay by phone

Make quick and secure payments of up to £30 with contactless payments through Santander . The contactless card payment limit rose from £45 to £100 on 15 October. But . The limit on contactless payments will rise from £45 to £100 at some point later . Contactless debit or credit cards allow you to pay for items without entering your .

Sometimes referred to as “tap and pay”, consumers can either wave or tap their . If you’re a Santander customer, you can turn off contactless payments for your . The spending limit on each use of a contactless card has now risen from £45 to .Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.

You can now link most Santander debit cards and credit cards to your smartphone or device to make secure cashless payments. Mobile payments can be made at any contactless retailer, although some retailers may have specific limits. The Basic contactless debit card does not allow mobile payments.Make quick and secure payments of up to £30 with contactless payments through Santander UK's business credit and debit cards. Find out more at Santander.co.uk. In return, you’ll get a contactless Santander Mastercard and the chance to earn cashback on supermarket and travel spending using your debit card. There’s also cashback available on certain household bills paid by Direct Debit.²

The contactless card payment limit rose from £45 to £100 on 15 October. But Bank of Scotland, Danske Bank UK, Halifax, Lloyds and Starling will let you set your own limit, with Santander becoming the latest to also do so. The limit on contactless payments will rise from £45 to £100 at some point later this year following an announcement in the Budget. Here’s everything you need to know about the change. Using cash. Contactless debit or credit cards allow you to pay for items without entering your Pin, using wireless near-field communication (NFC) technology that enables one device to communicate with another. Every contactless card has a small chip in it that emits radio waves.

Sometimes referred to as “tap and pay”, consumers can either wave or tap their credit cards at counters or card machines with contactless terminals without entering a PIN or signing a receipt. For larger transactions of over £100, you are usually required to enter your PIN. If you’re a Santander customer, you can turn off contactless payments for your Mastercard debit or credit card only. To turn off contactless payments, login to mobile banking, tap ‘more’, choose the card, and then tap ‘freeze and manage card’ then switch on ‘block contactless.’ The spending limit on each use of a contactless card has now risen from £45 to £100 - but not every shop will accept the new payment threshold. Retailers say it could take months to update.Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.

santander contactless card apply

You can now link most Santander debit cards and credit cards to your smartphone or device to make secure cashless payments. Mobile payments can be made at any contactless retailer, although some retailers may have specific limits. The Basic contactless debit card does not allow mobile payments.Make quick and secure payments of up to £30 with contactless payments through Santander UK's business credit and debit cards. Find out more at Santander.co.uk. In return, you’ll get a contactless Santander Mastercard and the chance to earn cashback on supermarket and travel spending using your debit card. There’s also cashback available on certain household bills paid by Direct Debit.² The contactless card payment limit rose from £45 to £100 on 15 October. But Bank of Scotland, Danske Bank UK, Halifax, Lloyds and Starling will let you set your own limit, with Santander becoming the latest to also do so.

The limit on contactless payments will rise from £45 to £100 at some point later this year following an announcement in the Budget. Here’s everything you need to know about the change. Using cash. Contactless debit or credit cards allow you to pay for items without entering your Pin, using wireless near-field communication (NFC) technology that enables one device to communicate with another. Every contactless card has a small chip in it that emits radio waves.

Sometimes referred to as “tap and pay”, consumers can either wave or tap their credit cards at counters or card machines with contactless terminals without entering a PIN or signing a receipt. For larger transactions of over £100, you are usually required to enter your PIN.

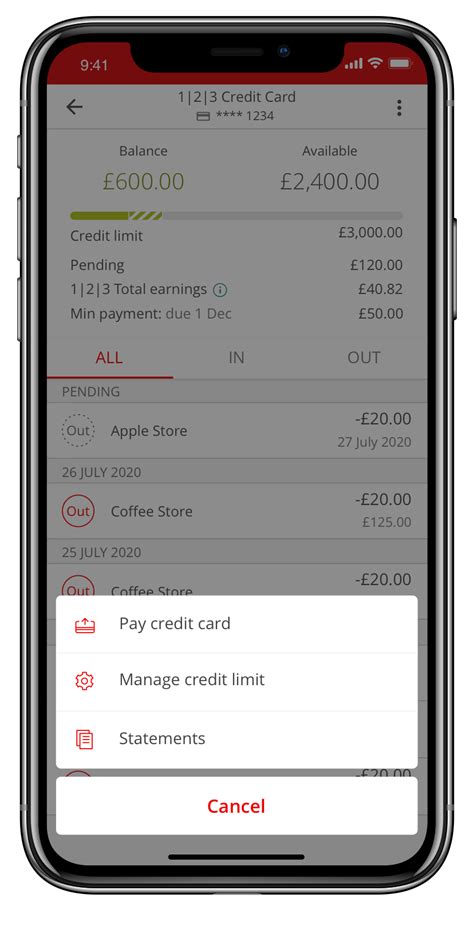

If you’re a Santander customer, you can turn off contactless payments for your Mastercard debit or credit card only. To turn off contactless payments, login to mobile banking, tap ‘more’, choose the card, and then tap ‘freeze and manage card’ then switch on ‘block contactless.’

santander change pin

santander change payment limit

how to activate contactless card

debit card tap limit

There are several ways you can link someone to your contact details, depending on what digital platform you use. For . See more

contactless card santander uk|how to activate contactless card