smart cards penetration in korea South Korea has seen a surge in the adoption of mobile payment systems in the past few years, with many consumers opting for contactless payment options over traditional credit cards. Of course you can’t. Some schools are piloting an authorized digital pass card .Using this, a pass in Passkit can emulate an NFC Card. BUT: You can only use this with an .

0 · south Korea mobile payment statistics

1 · south Korea digital payment market

2 · mobile payments in south Korea

3 · digital payments in Korea

In this video, we look at how to make an NFC business card that will allow us to tap someone's phone to share our website or contact details. NFC Business Ca.https://getconnectedmedia.com - In this video, we're going to show you how to program your own NFC Tags to operate as a digital business card. Conferences an.https://getconnectedmedia.com - In this video, we're going to show you how to program your own NFC Tags to operate as a digital business card. Conferences an.Open your Blinq app. Go to the “Accessories” tab on the menu. Design your NFC card and assign it to your chosen digital business card. Order your NFC business card direct from the Blinq app. Or, on your Blinq .

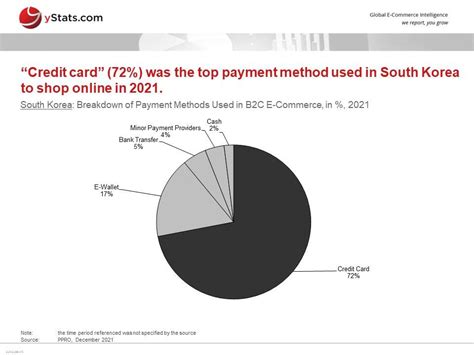

Also known as "easy payment services", mobile payment services in South Korea allow customers to make payments via smartphones using previously stored credit or debit card data. Users register.In addition, we use relevant key market indicators and data from country-specific associations, such as GDP, consumer spending, population, internet penetration, smartphone penetration, .The increasing ubiquity of smart devices and growing online retail commerce drive the adoption of real-time payments. In addition, rapid technological changes such as the rollout of 5G and .The South Korean Payments Market is Segmented by Mode of Payment (Point of Sale (Card Payments, Digital Wallet, Cash), Online Sale (Card Payments, Digital Wallet)), and by End .

South Korea has seen a surge in the adoption of mobile payment systems in the past few years, with many consumers opting for contactless payment options over traditional credit cards. Mobile wallet payments are becoming the ‘mainstream’ payment method in South Korea, gradually displacing traditional payments such as cash and cards, with nearly two-thirds of South Koreans using mobile wallets at .

According to data released by the Bank of Korea (BOK), Tuesday, consumers are increasingly using digital wallets to buy goods, with the average daily number of payments .In addition, the high penetration of smart cards in access control & personal identification applications, increasing requirement of smart cards to avail e-government services, and growing demand for online shopping & banking are .South Korea Smart Card Market Outlook | Value, Companies, Revenue, Forecast, Analysis, Trends, Growth, Size, COVID-19 IMPACT, Industry & Share License Type (Single, .

South Korea’s payment cards market is well developed and has been on a sustained growth for the past few years. High banked population, developed payment . Also known as "easy payment services", mobile payment services in South Korea allow customers to make payments via smartphones using previously stored credit or debit card data. Users register.

In addition, we use relevant key market indicators and data from country-specific associations, such as GDP, consumer spending, population, internet penetration, smartphone penetration, credit.The increasing ubiquity of smart devices and growing online retail commerce drive the adoption of real-time payments. In addition, rapid technological changes such as the rollout of 5G and increased smartphone penetration across South Korea encourage real-time payments.The South Korean Payments Market is Segmented by Mode of Payment (Point of Sale (Card Payments, Digital Wallet, Cash), Online Sale (Card Payments, Digital Wallet)), and by End-user Industries (Retail, Entertainment, Healthcare, Hospitality).

South Korea has seen a surge in the adoption of mobile payment systems in the past few years, with many consumers opting for contactless payment options over traditional credit cards. Mobile wallet payments are becoming the ‘mainstream’ payment method in South Korea, gradually displacing traditional payments such as cash and cards, with nearly two-thirds of South Koreans using mobile wallets at shops, according to GlobalData, a leading data and analytics company. According to data released by the Bank of Korea (BOK), Tuesday, consumers are increasingly using digital wallets to buy goods, with the average daily number of payments ticking up 13.4 percent.

In addition, the high penetration of smart cards in access control & personal identification applications, increasing requirement of smart cards to avail e-government services, and growing demand for online shopping & banking are some of the factors that fuel the market growth of smart cards during the forecast period.South Korea Smart Card Market Outlook | Value, Companies, Revenue, Forecast, Analysis, Trends, Growth, Size, COVID-19 IMPACT, Industry & Share License Type (Single, . South Korea’s payment cards market is well developed and has been on a sustained growth for the past few years. High banked population, developed payment infrastructure and high financial awareness has resulted in high card penetration and usage. Also known as "easy payment services", mobile payment services in South Korea allow customers to make payments via smartphones using previously stored credit or debit card data. Users register.

In addition, we use relevant key market indicators and data from country-specific associations, such as GDP, consumer spending, population, internet penetration, smartphone penetration, credit.

The increasing ubiquity of smart devices and growing online retail commerce drive the adoption of real-time payments. In addition, rapid technological changes such as the rollout of 5G and increased smartphone penetration across South Korea encourage real-time payments.The South Korean Payments Market is Segmented by Mode of Payment (Point of Sale (Card Payments, Digital Wallet, Cash), Online Sale (Card Payments, Digital Wallet)), and by End-user Industries (Retail, Entertainment, Healthcare, Hospitality).

South Korea has seen a surge in the adoption of mobile payment systems in the past few years, with many consumers opting for contactless payment options over traditional credit cards. Mobile wallet payments are becoming the ‘mainstream’ payment method in South Korea, gradually displacing traditional payments such as cash and cards, with nearly two-thirds of South Koreans using mobile wallets at shops, according to GlobalData, a leading data and analytics company. According to data released by the Bank of Korea (BOK), Tuesday, consumers are increasingly using digital wallets to buy goods, with the average daily number of payments ticking up 13.4 percent.

south Korea mobile payment statistics

In addition, the high penetration of smart cards in access control & personal identification applications, increasing requirement of smart cards to avail e-government services, and growing demand for online shopping & banking are some of the factors that fuel the market growth of smart cards during the forecast period.South Korea Smart Card Market Outlook | Value, Companies, Revenue, Forecast, Analysis, Trends, Growth, Size, COVID-19 IMPACT, Industry & Share License Type (Single, .

fuel nozzle rfid reader

free rfid reader writer software

By tapping the amiibo card or figure on the NFC touchpoint of your Nintendo Switch, you can scan the character's amiibo. Scan Complete! The character will appear on the screen and will visit the Campsite! List of Animal .How do I use cardless access at Chase ATMs? Once at the ATM, open the mobile wallet on your phone and select your eligible Chase debit card. Eligible mobile wallets include Apple Pay and Samsung Pay. Tap your phone on the .

smart cards penetration in korea|south Korea digital payment market