one smart card fees 1. Via a Mastercard or Visa debit card issued in New Zealand. Instantly load NZD or any of our eight foreign currencies available with your debit card. A fee of 1.5% of the load value applies per transaction. Your funds will be available immediately. 2. Via Bank Transfer. Load directly into . STEP 1: Personalize your card! Choose from 10 different metal card colors. Customize Your Own or browse our Premade Designs! STEP 2: Ship your card! Check your email, we will send you detailed shipping instructions & provide .

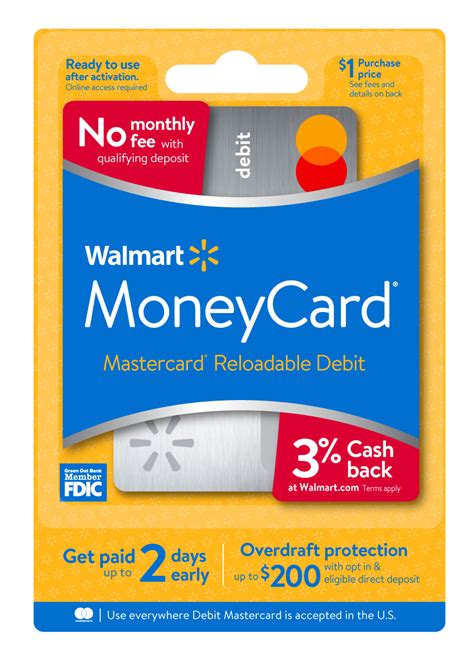

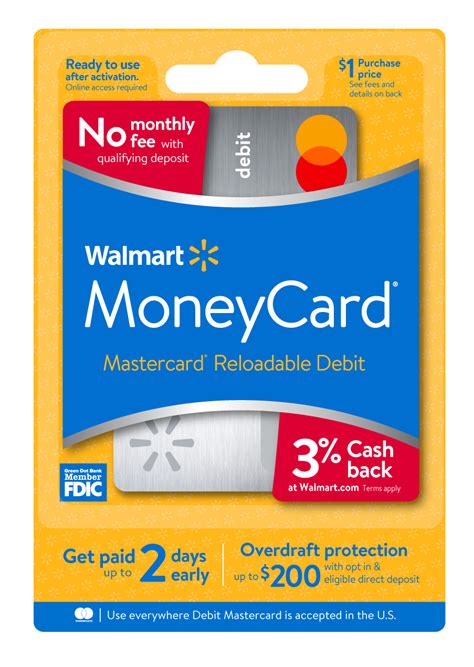

0 · walmart one pay credit card

1 · walmart one credit card

2 · one walmart debit card

3 · one debit card offer

4 · one credit card sign in

China MIFARE Card wholesale - Select 2024 high quality MIFARE Card .

1. Via a Mastercard or Visa debit card issued in New Zealand. Instantly load NZD or any of our eight foreign currencies available with your debit card. A fee of 1.5% of the load value applies per transaction. Your funds will be available immediately. 2. Via Bank Transfer. Load directly into .

sim card smart price

Please refer to our FAQs.If you can't find the answer to a question contact OneSmart™ Sup.Collect 1 Airpoints Dollar for every NZD0 spent overseas and every NZD0 spent in New .4.35% APY on Savings. With eligible deposits. Get paid up to 2 days early. With direct deposit. No monthly fees. Or minimum balances. Credit Builder. Build your credit with zero fees* Set aside just a month to build your credit history, .

walmart one pay credit card

1. Via a Mastercard or Visa debit card issued in New Zealand. Instantly load NZD or any of our eight foreign currencies available with your debit card. A fee of 1.5% of the load value applies per transaction. Your funds will be available immediately. 2. Via Bank Transfer. Load directly into foreign currency or NZD without a fee. Here are the .Collect 1 Airpoints Dollar for every NZD0 spent overseas and every NZD0 spent in New Zealand. Withdraw local currency from any ATM where Mastercard is accepted. The first three international ATM withdrawals are free each month. ~.

4.35% APY on Savings. With eligible deposits. Get paid up to 2 days early. With direct deposit. No monthly fees. Or minimum balances. Credit Builder. Build your credit with zero fees* Set aside just a month to build your credit history, with 0+ in monthly eligible direct deposits. Get started. Learn More. No credit check or score required. OneSmart travel card is a prepaid card offering Airpoints dollars and can be used anywhere Mastercard is accepted. Although the card comes with fees and limited currencies, it can make sense for New Zealand residents who want to earn Airpoints.OneSmart also charges a pesky /month fee to use the card, which we find to be most unnecessary. While cardholders earn 1 Airpoints Dollar per NZ0 spent on their OneSmart card, we believe the extra costs and lower exchange rates don't compensate for this benefit. There is no initial OneSmart card fee, or reloading fee (for bank transfers), however there are some associated costs, including: 1.5% fee for instant debit card loads; International ATM withdrawls (first three international withdrawals each month are free) NZ domestic ATM withdrawal fee; Currency conversion fee of 2.5% of transaction value

walmart one credit card

one walmart debit card

According to Canstar's deep-dive into the fineprint on fees and charges, the top three travel money cards on the market are: Travelex's Money Card, Qantas Cash and Air New Zealand's OneSmart.

If you're somebody who books a large number of flights and don't rely on credit card travel insurance for international travel, you could easily save hundreds of dollars per year in credit card fees simply by using your OneSmart card to pay for your flights.

There’s no annual or monthly fee for either Wise or OneSmart. There’s no foreign transaction fee with Wise, and currency conversion costs start from 0.43%. With OneSmart, the exchange rate used to convert funds to the required currency will include a markup.

By applying for the OneSmartTM prepaid payment facility (“OneSmart”) you agree to comply with these Terms and Conditions. OneSmart is issued by Travelex Card Services Limited. A Product Disclosure Statement for the offer of OneSmart is available and can be obtained from www. airnzonesmart.co.nz.1. Via a Mastercard or Visa debit card issued in New Zealand. Instantly load NZD or any of our eight foreign currencies available with your debit card. A fee of 1.5% of the load value applies per transaction. Your funds will be available immediately. 2. Via Bank Transfer. Load directly into foreign currency or NZD without a fee. Here are the .Collect 1 Airpoints Dollar for every NZD0 spent overseas and every NZD0 spent in New Zealand. Withdraw local currency from any ATM where Mastercard is accepted. The first three international ATM withdrawals are free each month. ~.4.35% APY on Savings. With eligible deposits. Get paid up to 2 days early. With direct deposit. No monthly fees. Or minimum balances. Credit Builder. Build your credit with zero fees* Set aside just a month to build your credit history, with 0+ in monthly eligible direct deposits. Get started. Learn More. No credit check or score required.

OneSmart travel card is a prepaid card offering Airpoints dollars and can be used anywhere Mastercard is accepted. Although the card comes with fees and limited currencies, it can make sense for New Zealand residents who want to earn Airpoints.OneSmart also charges a pesky /month fee to use the card, which we find to be most unnecessary. While cardholders earn 1 Airpoints Dollar per NZ0 spent on their OneSmart card, we believe the extra costs and lower exchange rates don't compensate for this benefit.

There is no initial OneSmart card fee, or reloading fee (for bank transfers), however there are some associated costs, including: 1.5% fee for instant debit card loads; International ATM withdrawls (first three international withdrawals each month are free) NZ domestic ATM withdrawal fee; Currency conversion fee of 2.5% of transaction value According to Canstar's deep-dive into the fineprint on fees and charges, the top three travel money cards on the market are: Travelex's Money Card, Qantas Cash and Air New Zealand's OneSmart.

If you're somebody who books a large number of flights and don't rely on credit card travel insurance for international travel, you could easily save hundreds of dollars per year in credit card fees simply by using your OneSmart card to pay for your flights.There’s no annual or monthly fee for either Wise or OneSmart. There’s no foreign transaction fee with Wise, and currency conversion costs start from 0.43%. With OneSmart, the exchange rate used to convert funds to the required currency will include a markup.

one debit card offer

one credit card sign in

$17.17

one smart card fees|walmart one credit card